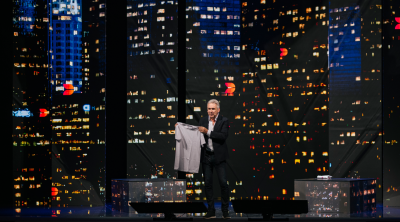

PierMario Barzaghi, partner and head of sustainability services for KPMG Italy, tells Future how ESG reporting, with an eye for the concerns of all stakeholders, is integral to good enterprise risk management

As KPMG’s partner responsible for climate change and sustainability services in Italy, as well as a member of the Technical Expert Group for the elaboration of European non-financial reporting standards, PierMario Barzaghi is an expert in sustainability and integrated reporting. With new sustainability reporting standards set to be introduced in Europe and existing regulations extended, he discusses how ESG (Environmental, Social and Governance) reporting is responding to increased regulatory demands and growing consumer and public pressure.

What are the defining social, ethical and environmental factors impacting on the drafting of social reports and non-financial reporting currently?

PierMario Barzaghi: The main areas of focus on ESG issues and which are subject to reporting depend on many factors, in particular the sector of activity and the business model. At the moment there is a tendency to focus on environmental aspects, with climate change being the most topical issue, due to both the EU green taxonomy and the sensitivity of stakeholders. Driven by regulations coming from the EU, however, we will soon see a focus on other environmental issues such as water use, waste, biodiversity, and reuse of raw materials.

Soon, the introduction of other European regulations such as CS3D [the Corporate Sustainability Due Diligence Directive], and the extension of the EU taxonomy to social aspects, will turn the spotlight on the corporate value chain, working conditions, wages, gender diversity, etc. Governance, although underestimated, is already addressed by listed companies thanks to codes of reference and regulations governing aspects such as anti-corruption and gender diversity on boards.

What is driving those factors?

PierMario Barzaghi: In the end it took legislation in 2016 for sustainability issues to become a priority (Legislative Decree 254/16), albeit limited mainly to large, listed companies. Even now, the regulations applicable to the financial world (SFRD, EU taxonomy, climate risk European Banking Authority’s ESG Pillar 3 framework) are a decisive guiding factor, even if consumer and public pressure is becoming increasingly important. The real challenge now is to transform regulatory compliance into a corporate strategy integrated with business development plans.

How is ESG risk reporting evolving for the better? What have been the biggest gearshifts in how reporting is evolving?

PierMario Barzaghi: The proper mapping of ESG risks and their integrated management with all corporate risks in an enterprise risk management process is crucial for the achievement of corporate economic and financial objectives. It is therefore necessary to reconsider business processes and to review internal responsibilities. Hence the need to extend internal competences on sustainability issues to all corporate functions, without exception. We are facing a revolution that must take into account the legitimate expectations of all stakeholders, opening up towards the concept of stakeholder capitalism.

How do you think the evolution of the guidelines of Global Reporting Initiative (GRI) and the definition of new guidelines at European level for the certification of sustainability reports are likely to be received by the corporate community?

PierMario Barzaghi: It is imperative that there is convergence between all existing standards, in particular GRI, EFRAG/ESRS [the European Financial Reporting Advisory Group/the European Sustainability Reporting Standards] and IFRS/ISSB [the International Financial Reporting Standard/the International Sustainability Standards Board]. This is necessary to facilitate reporting and avoid interpretative confusion on the part of companies.

The EFRAG standards, which are still in consultation and will be published by June 2023, have aligned themselves in an important way with the other standards, distinguishing themselves by some peculiarities such as the double materiality and the extended reporting scope to the value chain.

Based on a multi-stakeholder approach, these standards aim to cover a broad spectrum of topics and, in order to facilitate the comparability of companies’ sustainability reporting, require a significant amount of qualitative and quantitative information that is sometimes difficult to obtain. For this reason, criticism or, rather, concern on the part of companies was immediate.

How does an accurate, measurable sustainability statement give an organization a competitive advantage and reflect positively on them?

PierMario Barzaghi: Embarking on a path of sustainability by defining a clear strategy of sustainable development, [and] good risk management thanks to a governance attentive to ESG issues such as the identification of decarbonization targets that are reported in transparent and reliable reporting, consolidates the relationship of trust with internal and external stakeholders, limiting reputational risks. It allows us to seize market opportunities, innovate with new products, and enhance the skills of human capital, which represent new competitive factors.

What does the future look like for ESG reporting? How will it continue to improve and, ultimately, help businesses?

PierMario Barzaghi: It will be important to flank the sustainability statement – which must, by law, be included in the consolidated financial statements – with ESG managerial reporting in order to monitor whether sustainability objectives have been met and, if necessary, to redirect actions. It is important to integrate the company’s economic and financial objectives with sustainability objectives, which must be quantitative and detailed and linked to the company’s activities. Think of the need to innovate new products that are more sustainable, new raw materials for reuse, greater energy efficiency, new logistics, new packaging. Ultimately, companies must think of sustainability not as a foreign body but as a core business, otherwise they could have serious problems with business continuity.

Further details:

For more information on EFRAG’s work on sustainability reporting standards, visit www.efrag.org

PierMario Barzaghi is partner and head of sustainability services for KPMG Italy